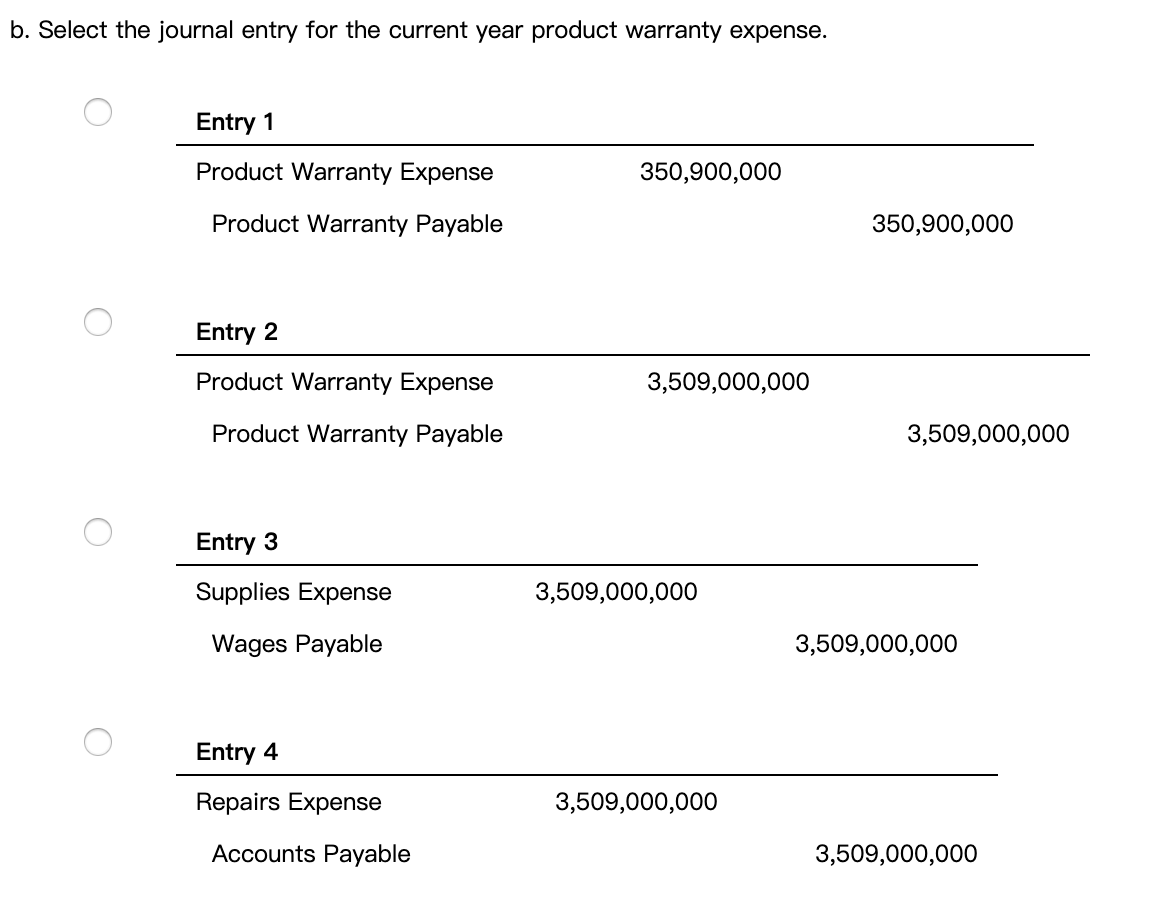

Warranty Related Journal Entries . the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. in the later section below, we illustrate some of the examples showing how to account for warranty and passing journal entries to. we must estimate the expense based on previous company history and record the journal entry. the journal entry for the recording of warranty expenses is as under: please prepare journal entry for warranty expenses. Later on, if a certain warranty is claimed, the liability for warranty. In order for a company to. the journal entry used to record this transaction is:

from www.chegg.com

in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. please prepare journal entry for warranty expenses. the journal entry for the recording of warranty expenses is as under: we must estimate the expense based on previous company history and record the journal entry. in the later section below, we illustrate some of the examples showing how to account for warranty and passing journal entries to. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: In order for a company to. the journal entry used to record this transaction is: Later on, if a certain warranty is claimed, the liability for warranty.

Solved Harbour Company disclosed estimated product warranty

Warranty Related Journal Entries please prepare journal entry for warranty expenses. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. the journal entry for the recording of warranty expenses is as under: we must estimate the expense based on previous company history and record the journal entry. in the later section below, we illustrate some of the examples showing how to account for warranty and passing journal entries to. the journal entry used to record this transaction is: please prepare journal entry for warranty expenses. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: Later on, if a certain warranty is claimed, the liability for warranty. In order for a company to.

From www.chegg.com

Solved Exercise 910 Warranty expense and liability Warranty Related Journal Entries in the later section below, we illustrate some of the examples showing how to account for warranty and passing journal entries to. In order for a company to. Later on, if a certain warranty is claimed, the liability for warranty. we must estimate the expense based on previous company history and record the journal entry. the journal. Warranty Related Journal Entries.

From www.chegg.com

Solved 6 PROBLEM 9 Warranty liabilities 2 journal entries Warranty Related Journal Entries please prepare journal entry for warranty expenses. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. the journal entry for the recording of warranty expenses is as under: Later on, if a certain warranty is claimed, the liability for warranty. the double entry bookkeeping. Warranty Related Journal Entries.

From www.geeksforgeeks.org

Provisions in Accounting Meaning, Accounting Treatment, and Example Warranty Related Journal Entries we must estimate the expense based on previous company history and record the journal entry. the journal entry used to record this transaction is: the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: the journal entry for the recording of warranty expenses is as under: Later on,. Warranty Related Journal Entries.

From quickbooks.intuit.com

How to use Excel for accounting and bookkeeping QuickBooks Warranty Related Journal Entries please prepare journal entry for warranty expenses. In order for a company to. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. we must estimate the expense based on previous company history and record the journal entry. the journal entry for the recording of. Warranty Related Journal Entries.

From www.studocu.com

Chapter 3 Warranty Liability ANDREA GERALDINO BSA 2B CHAPTER 3 Warranty Related Journal Entries the journal entry for the recording of warranty expenses is as under: Later on, if a certain warranty is claimed, the liability for warranty. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: please prepare journal entry for warranty expenses. the journal entry used to record this. Warranty Related Journal Entries.

From www.youtube.com

Accounting Warranty Expense and Liability Severson YouTube Warranty Related Journal Entries please prepare journal entry for warranty expenses. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: Later on, if a certain warranty is claimed, the liability for. Warranty Related Journal Entries.

From www.chegg.com

Solved ACcrued product warranty 1. Instructions Chart of Warranty Related Journal Entries Later on, if a certain warranty is claimed, the liability for warranty. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: we must estimate the expense based on previous company history and record the journal entry. the journal entry for the recording of warranty expenses is as under:. Warranty Related Journal Entries.

From www.chegg.com

Solved Prepare journal entries to record the following Warranty Related Journal Entries the journal entry used to record this transaction is: In order for a company to. Later on, if a certain warranty is claimed, the liability for warranty. please prepare journal entry for warranty expenses. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: we must estimate the. Warranty Related Journal Entries.

From www.slideshare.net

Unit 11 Current Liabilities and Contingent Liabilities Warranty Related Journal Entries Later on, if a certain warranty is claimed, the liability for warranty. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: the journal entry used to record this transaction is: in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty. Warranty Related Journal Entries.

From www.chegg.com

Solved Dell Inc. sells computer products as well as Warranty Related Journal Entries please prepare journal entry for warranty expenses. the journal entry used to record this transaction is: in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. in the later section below, we illustrate some of the examples showing how to account for warranty and passing. Warranty Related Journal Entries.

From www.chegg.com

Solved 1. Record the sales, warranty expense, and Warranty Related Journal Entries the journal entry used to record this transaction is: Later on, if a certain warranty is claimed, the liability for warranty. in the later section below, we illustrate some of the examples showing how to account for warranty and passing journal entries to. In order for a company to. the double entry bookkeeping journal required to record. Warranty Related Journal Entries.

From www.carunway.com

Warranty Expense Journal Entry CArunway Warranty Related Journal Entries the journal entry used to record this transaction is: Later on, if a certain warranty is claimed, the liability for warranty. we must estimate the expense based on previous company history and record the journal entry. please prepare journal entry for warranty expenses. the double entry bookkeeping journal required to record the estimated warranty costs for. Warranty Related Journal Entries.

From www.slideserve.com

PPT Accounting 1120 PowerPoint Presentation, free download ID3250532 Warranty Related Journal Entries Later on, if a certain warranty is claimed, the liability for warranty. In order for a company to. please prepare journal entry for warranty expenses. the journal entry for the recording of warranty expenses is as under: we must estimate the expense based on previous company history and record the journal entry. the journal entry used. Warranty Related Journal Entries.

From www.youtube.com

Journal Entries for AssuranceType Warranties RE99 YouTube Warranty Related Journal Entries we must estimate the expense based on previous company history and record the journal entry. the journal entry for the recording of warranty expenses is as under: the journal entry used to record this transaction is: In order for a company to. the double entry bookkeeping journal required to record the estimated warranty costs for year. Warranty Related Journal Entries.

From www.chegg.com

Solved 1) Prepare journal entries to record the above Warranty Related Journal Entries the journal entry used to record this transaction is: please prepare journal entry for warranty expenses. we must estimate the expense based on previous company history and record the journal entry. the journal entry for the recording of warranty expenses is as under: in the later section below, we illustrate some of the examples showing. Warranty Related Journal Entries.

From fundsnetservices.com

Journal Entry Examples Warranty Related Journal Entries Later on, if a certain warranty is claimed, the liability for warranty. we must estimate the expense based on previous company history and record the journal entry. please prepare journal entry for warranty expenses. the journal entry for the recording of warranty expenses is as under: the journal entry used to record this transaction is: . Warranty Related Journal Entries.

From www.pearson.com

Warranty Payable Journal Entries Channels for Pearson+ Warranty Related Journal Entries Later on, if a certain warranty is claimed, the liability for warranty. the journal entry for the recording of warranty expenses is as under: the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: please prepare journal entry for warranty expenses. In order for a company to. in. Warranty Related Journal Entries.

From www.chegg.com

Solved Prepare 2020 entries for Sweet assuming that the Warranty Related Journal Entries In order for a company to. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: we must estimate the expense based on previous company history and record the journal entry. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty. Warranty Related Journal Entries.